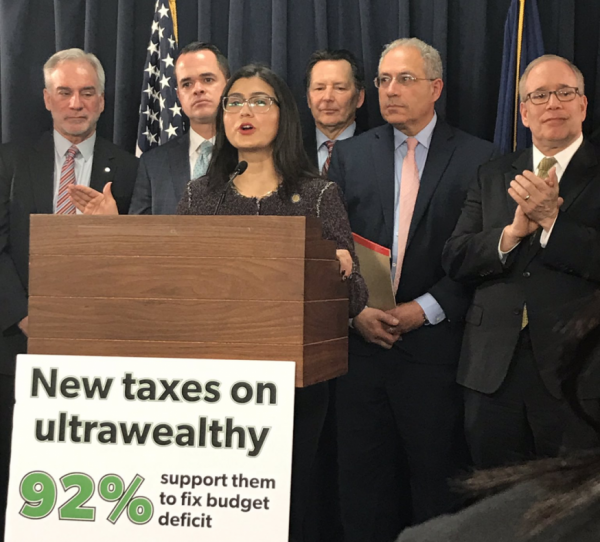

(Jessica Ramos Twitter)

Feb. 10, 2020 By Kristen Torres

Several Queens lawmakers joined officials from a prominent teachers union Monday to unveil results of a new poll that showed broad support for a proposed state-wide wealth tax.

An overwhelming majority of survey respondents—92 percent—supported new taxes on New York’s millionaires and billionaires as a way to cover the state’s budget deficit, which currently stands at $6.1 billion.

The survey, which was conducted by Hart Research Associates and based on the response of 1,000 registered New York voters, revealed widespread support for a wealth tax on New Yorkers with more than $1 billion, and for a new tax on residents with incomes of more than $5 million. The survey was released by the United Federation of Teachers.

Survey respondents also supported a pied-à-terre tax.

“We won’t be able to survive in New York if we don’t get the wealthy to pay their fair share in taxes,” said State Senator Jessica Ramos in a tweet Monday.

Support for the new taxes spanned party lines, with 95 percent of Democrats, 87 percent of Republicans and 89 percent of unaffiliated voters backing the tax proposals, according to survey results.

City Council Speaker Corey Johnson came out in support of higher taxes for the city’s ultra-rich, and said he’s fighting for a state budget that asks the wealthiest residents to pay their fair share.

“I’m in Albany…fighting for a fair budget that asks the wealthiest New Yorkers to kick in a little bit more,” Johnson tweeted Monday.

State Senator Michael Gianaris—who represents Astoria, Long Island City and Sunnyside/Woodside— also voiced his support for the proposed taxes on Monday.

“In a state and a city that has incredible wealth as well as incredible poverty, it seems fair to ask those who can afford it to help chip in more so that we can properly address some of these priorities,” Gianaris said.

The New York State United Teachers Union said the poll shows New Yorkers believe taxing the ultra-rich is the right way to make “significant investments in critical state services,” such as education, health care, public housing and transportation.

The NYSUT also said imposing a wealth tax on the more than 46,000 multimillionaires living in the state would generate more than $12 billion in revenue for the state.

15 Comments

Yeah raise the taxes turn nyc into a waste land like Detroit. Just like a great communist by the name of Coleman young. Why is it our commissar’s home he is pay 4k on a 2 million dollar I pay almost three times as much?? Yep make it harder to live in nyc . Reap the ramifications you clowns. How are u going to get blood from a stone when you have freeloaders occupying residential homes who don’t work?? Wake up Queens

“We won’t be able to survive in New York if we don’t get the wealthy to pay their fair share in taxes,” said State Senator Jessica Ramos in a tweet Monday.’ – you have got to be kidding. If your only chance of survival in this world is not by creating something of your own but by forcibly taking it from someone else your whole self-existence is pathetic and unnecessary.

So every year the businessmen would have to sell part of their business to pay this tax? Who did they ask about the support for this tax, the people with little understanding about how it even works?? This is alarming!

VVNY- You do know taxes are proportional to income? Why in the world would anybody need to “catabolize” itself? Do you sell your TV every time the con Edison bill is due?

Mac, you only prove my point. People have no idea what wealth tax is. Wealth tax is not a tax on income but it’s a tax on wealth, i.e. everything that a person owns. How do you measure it? Let’s say you have zero income but you own a home that you just bought for $1M. Let’s say next year the price of your home went up to $1.5M. You now owe tax on the $0.5M even though you didn’t sell your home. Would you be happy with this result?

@VVNY. “The survey, which was conducted by Hart Research Associates and based on the response of 1,000 registered New York voters, revealed widespread support for a wealth tax on New Yorkers with more than $1 billion, and for a new tax on residents with incomes of more than $5 million.” A wealth tax is calculated using a total net worth of an individual or “ company” ( the difference between assets and liabilities). A wealth tax is also known as an equity tax. You’re the one who doesn’t appear to have any idea of a what a wealth tax is. The tax is a levy on total value of “personal” assets. (Bank Accounts, real estate, assets in insurance and pension plans, ownership stakes in unincorporated businesses, financial securities and personal trusts). As I said I don’t see any reason to cannibalize. Do people sell their houses to meet their property taxes? Property tax is considered by many economic matrixes to be a wealth tax. The same asset is taxed over and over. I never said I agreed with the proposal but you’re obviously creating a smokescreen to relinquish your over reaction claiming people would have to have a fire sale to meet tax obligations. Ridiculous.

Mac, I gave you an overly simplistic example to show a flow in your argument that a wealth tax has anything to do with income. Income is taxed already at current income tax rates. As for property tax, before you buy a home you factor in the property tax in your monthly payments. The businesses would then have to start factoring in the wealth tax in their costs as well which will be passed down to consumers. And what happens if the value of the assets goes down in one or more years? Will the government then give back a refund to that business/ individuals? Also with real property it’s easier to access how much the property is worth and it’s not done on the market value but the assessed value. How do do you asses the value of the multitude of things that someone owns. Imagine an individual with investments that have no readily available information to assess their value? This invites tax avoidance by default. There is a reason that this type of tax have not taken traction elsewhere.

@VVNY- Wealth tax are nothing new. France, Portugal, and Spain are example of countries that do, but Austria, Denmark, Germany, Sweden, Finland, Iceland, and Luxembourg have abolished it in recent years. The United States doesn’t impose a wealth tax. Companies, individuals and trusts already track assets that are hard to price and other intangibles using methods such as the Black Sholes Model and methods and calculations utilized by FASB. Just recently the state Florida had a tangibles tax which was later repealed. Of course an assets valuation can go down in less then a year, it happens all the time and FASB and Black Sholes take these fluctuations into account in their rules actuarial tables and algorithms. What’s crazy Fox Entertainment owns a business station and refuses to enlighten it viewers with this information ( and I’m not talking about for or against the wealth tax, just inform its viewers on how it works) I went through debating uninformed and deliberately misinformed highly opinionated Fox enthusiasts over the Uranium One Hoax that was a complete fairy tale. It gets exhausting educating the easily incited misinformed.

Mac. I get it. Your point is that if you work in financial services industry and it is easy for you to comprehend the theory behind wealth tax that for others should it should be that easy too and that its application would work just as soundly as it is supposed to on paper, according to you. I stumbled on you by chance but I bet most people who were polled have no idea what wealth tax is and how complicated it can get given actual application. France and other countries you mentioned while still having this type of tax are realizing now that it’s not the best way to tax the rich. Please read about it. Chao.

Why don’t you cut your spending!! Your going to chase everyone out of here!! Tax Tax Tax. That’s all they know. Stop giving away everything. Buckle down on the welfare abusers.

What’s going to stop the billionaires and millionaires from leaving the state if this tax is enacted? Who pays then?

YOU!!!

What ever happened to the inheritance tax?? Why can’t that be bought back?? As it stands now the wealthy are moving out of NY…

John are you sure the wealthy are moving out of NY? I’ve googled this have not been able to find any confirmation of this.

Better yet, resurrect the dead and tax them