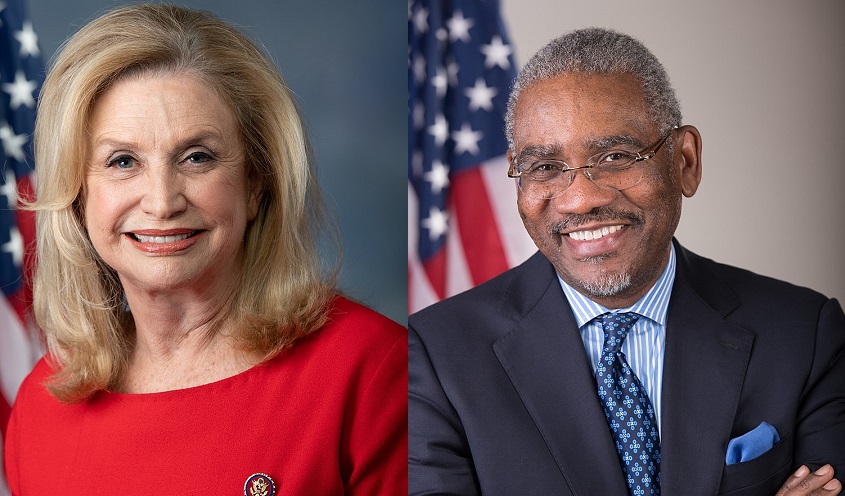

Reps. Carolyn Maloney and Gregory Meeks (U.S. House Office of Photography)

June 21, 2021 By Ryan Songalia

A legislative package that would require public companies to disclose social, environmental and governance metrics to investors passed the U.S. House of Representatives last Wednesday.

The Corporate Governance Improvement and Investor Protection Act passed along partisan lines – 215 to 214 – although four Democrats voted in opposition to the bill. All the congressional representatives from Queens voted in support of the bill.

The package includes an amendment – sponsored by Queens Rep. Gregory Meeks and co-sponsored by Carolyn Maloney – that would require public companies to disclose the racial, ethnic and gender composition of board members and executive officers.

The Improving Corporate Governance Through Diversity Act, as the amendment is known, would also require the Securities and Exchange Commission to establish a Diversity Advisory Group, which would carry out studies to identify strategies to increase racial, gender and ethnic diversity among boards.

The report would be submitted annually to the Committee on Banking, Housing, and Urban Affairs of the Senate, and the Committee on Financial Services of the House of Representatives.

The SEC’s Office of Minority and Women Inclusion would also publish best practices for compliance with the new disclosure rules three times a year, under the bill.

Maloney said she was inspired to act after a 2016 report from the Government Accountability Office showed that women make up just 16 percent of boardroom positions. She said the number needed to rise and that companies would benefit from doing so.

“Increasing diversity on corporate boards is not just a moral issue — it’s good for business too,” said Maloney last Wednesday during a speech on the House floor.

“Study after study has shown that companies with greater diversity on their boards perform better financially,” she said.

One of the other amendments to the bill, the Climate Risk Disclosure Act, drew praise from Rep. Alexandria Ocasio-Cortez for requiring public companies to disclose what impact they are having on climate change. The bill also requires that the SEC establish industry-specific climate standards for public companies.

Congressman Jim Hagedorn, a Republican from Minnesota, called the package “an attempt by [Speaker Nancy Pelosi] and House Democrats to bring cancel culture to board rooms and push their extreme left-wing social agenda.”

A companion bill to the Meeks amendment is in the U.S. Senate and is being sponsored by Sen. Robert Menendez of New Jersey and co-sponsored by Sen. Kirsten Gillibrand of New York. That bill was introduced on Feb. 23 but has not been brought up for a vote.

2 Comments

“Study after study has shown that companies with greater diversity on their boards perform better financially,” she said.

I doubt that any objective studies have shown that. Somebody ask her to identify them. It may be that companies with diverse boards have done well, but that is not necessarily related to the board’s makeup. More likely, they just have top notch management.

If what she says were true, then companies who do not voluntarily diversify their boards would be at a competitive disadvantage. Eventually they would go out of business. In such a situation there would be no need for politicians to demand board diversity. That they feel they have to do so anyway is proof that what they claim to be true is not true.

Be careful with this. While transparency is ok, don’t turn this into a woke, cancel culture, white man shame, entitlement, quota pork bill.

Doing that in the 1970s almost destroyed NYC and other major cities with the mandated welfare state. I know, I was there.

Equality is good, woke politics is not. The former elects Obama, the latter elects Trump.