Development in Long Island City (Photo: Queens Post)

April 16, 2021 By Christian Murray

A lucrative state tax break that has benefited a number of high-profile developers has come to an end.

State Sen. Mike Gianaris passed legislation that was included in the state budget that scraps a handsome tax break that allows developers who invest in designated “opportunity zones” to defer and later avoid paying capital gains tax.

Many of these “opportunity zones” are located in wealthy neighborhoods—including the Long Island City waterfront and Hudson Yards in Manhattan.

“Opportunity Zones are nothing more than a giveaway of public money to wealthy developers, and I’m glad New York took a stand against the much-abused program,” Gianaris said in a statement. “Much of the land eligible for these tax breaks is located among the richest and developed neighborhoods on earth.”

Gianaris’ legislation has reduced the tax advantage of a program that allows individuals and corporations to offset capital gains by investing in opportunity zones. The program was established by the Trump administration to spur investment in economically distressed neighborhoods.

Developers will continue to receive a federal tax break under the program– but Gianaris’ legislation brings the state component of the tax break to an end.

Under the program, a developer can—for example—sell a large property in Manhattan and then plow any capital gains into an opportunity zone. The developer’s capital gains taxes could then be deferred up to seven years by investing in a zone—with a modest cut in the taxes owed.

But more importantly, the developer would not face any capital gains on the property that was acquired within the opportunity zone if it is held for more than 10 years.

Many of the opportunity zones that are part of the program are in areas where large developments have been going up–or about to go up.

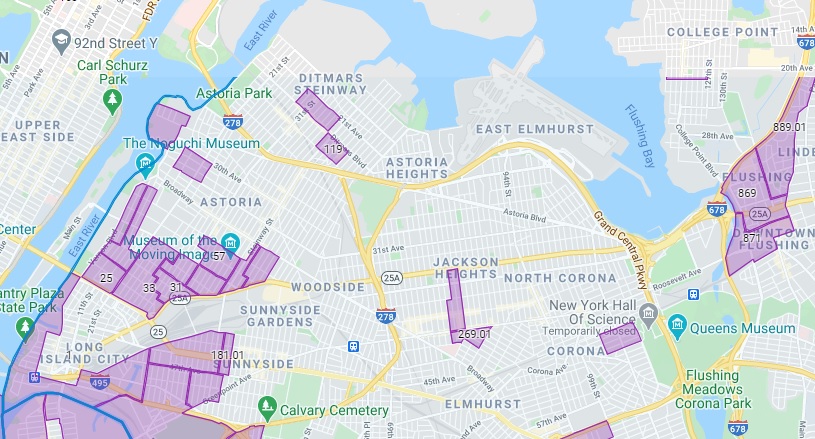

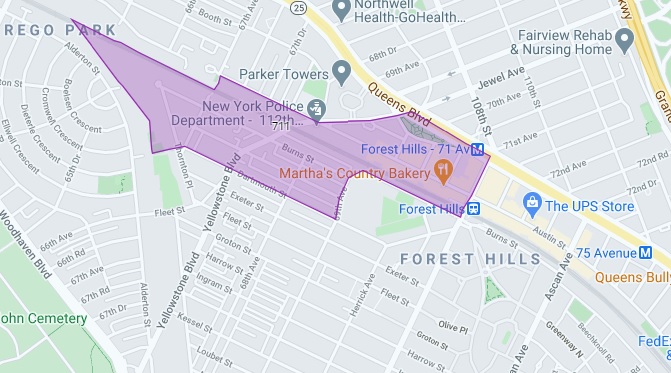

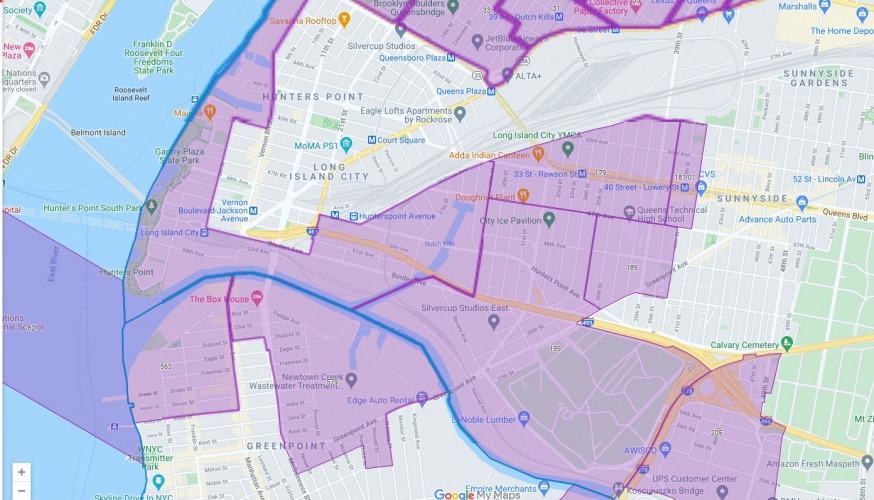

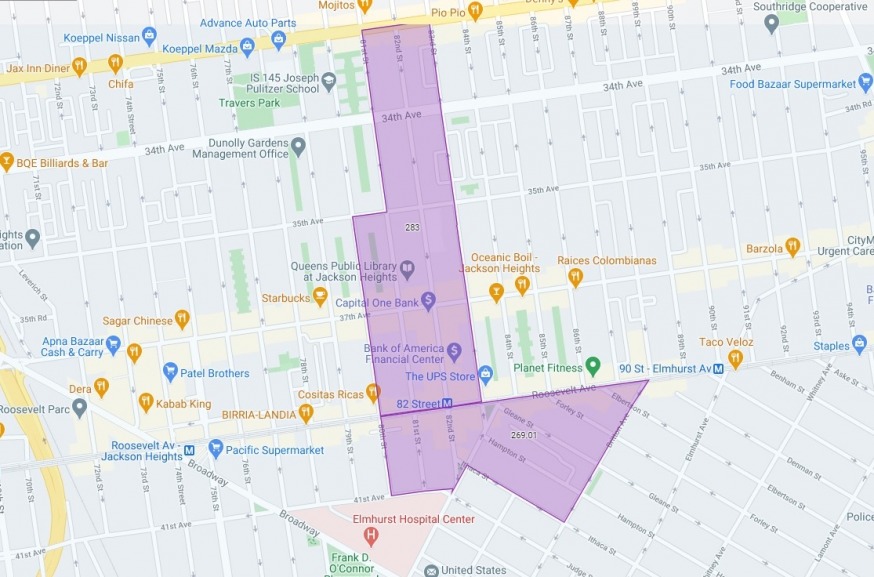

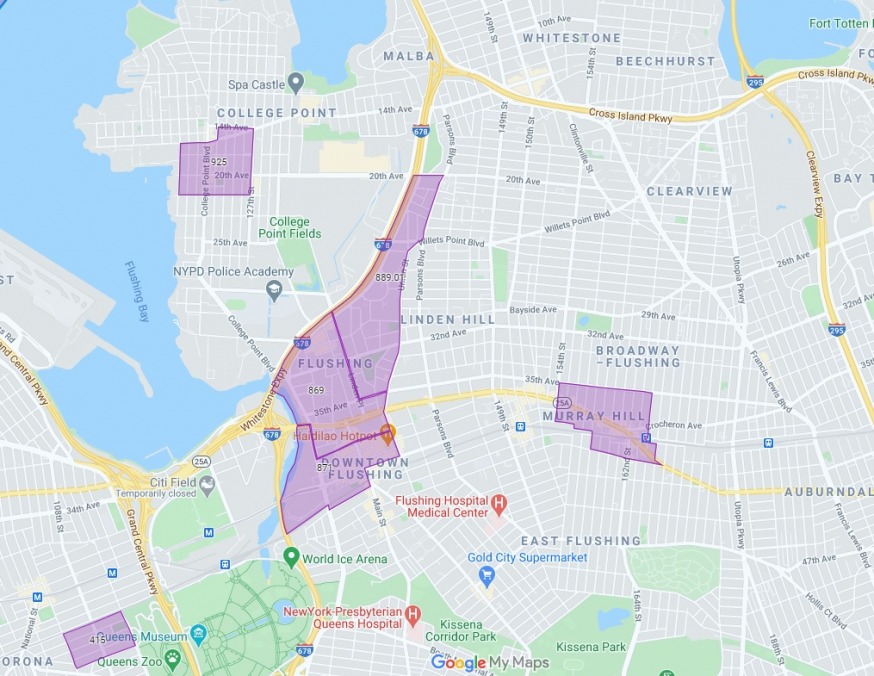

They include the Long Island City waterfront, the Flushing Creek, the Astoria waterfront–Hallets Cove peninsula, Austin Street in Forest Hills, 82nd Street in Jackson Heights, sections of Greenpoint, Brooklyn, and even Hudson Yards in Manhattan.

The zones were selected by the Cuomo administration in 2018.

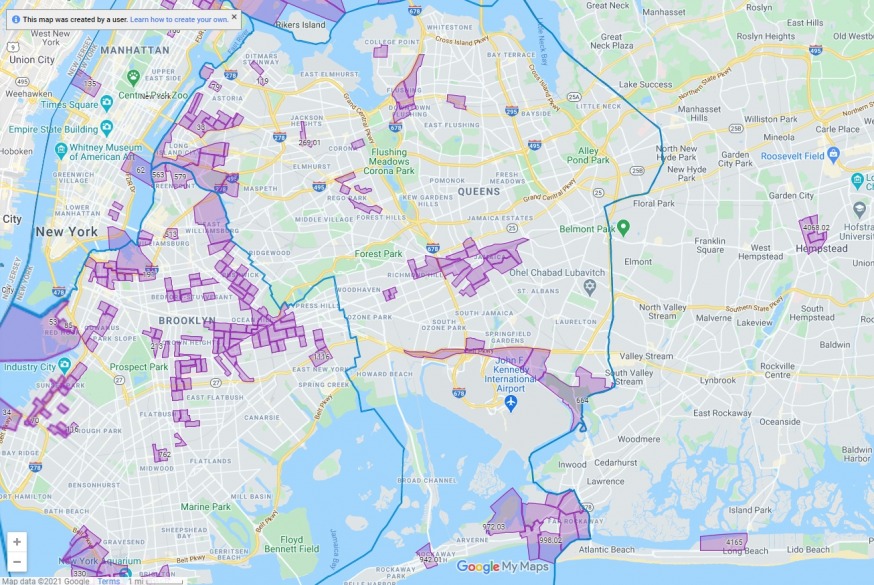

New York State Opportunity Zones (Empire State Development Corp. (https://esd.ny.gov/opportunity-zones)

The state had provided the capital gains tax break in line with the federal government as part of the program. Gianaris’ legalization has decoupled the benefit, ending the state component of the tax break. The capital gains tax in New York State is 8.8 percent.

The lucrative federal tax break will continue to remain in effect. However, Gianaris says that the end of the state tax break will save New York about $65 million per year.

“There is no good reason for tens of millions of public dollars to land in the pockets of developers in these areas,” Gianaris said in a statement.

Under the program, the U.S. Treasury identified 2,000 tracts in New York State that it deemed eligible for the designation. The initial list was based on data from 2011-2015.

An eligible tract had to have a poverty rate greater than or equal to 20 percent, or have a median family income less than 80 percent of the median for its metropolitan area.

From that list, the governor, via the Empire State Development Corp., was given the authority to determine the Opportunity Zones—comprised of no more than 25 percent of the tracts that the U.S. Treasury provided.

The state could also designate a limited number of zones that were adjacent to eligible tracts, subject to conditions.

One area that was selected that was adjacent to an eligible tract was the Long Island City waterfront. The zone does not meet the eligibility requirements but it is adjacent to NYCHA housing and therefore qualified.

“It’s not right that Hunters Point is included because it just so happens to be located next to Queens Bridge Houses,” Gianaris said.

“I don’t know exactly how they came up with the zones—but it smells,” Gianaris told the Queens Post last month. “There has been massive abuse [with this program].”

New York State Opportunity Zones (Empire State Development Corp. (https://esd.ny.gov/opportunity-zones)

Many high-profile developers have likely taken advantage of the program.

For instance, developers such as Larry Silverstein plowed big sums into buying underutilized properties by 35th Avenue and Steinway Street in 2019—part of an opportunity zone.

Silverstein in 2020 unveiled plans—as part of a consortium– to redevelop those parcels. The plans, dubbed Innovation QNS, call for 2,700 apartments as well as retail and office space.

Many areas that were already undergoing significant development were declared opportunity zones.

Durst Organization bought property on Hallets Cove in Astoria 2014, where its megadevelopment is going up. In 2018, that small area on the peninsula was carved out as an opportunity zone.

Durst also bought the Clocktower site in Long Island City in 2016, which is also incorporated as part of a zone.

“The Opportunity Zone program was intended to help economically distressed areas but is being abused to grant tax breaks to already overdeveloped neighborhoods,” Gianaris said.

The legislation was backed in the state senate by Jamaal Bailey, Brad Hoylman, Robert Jackson, Liz Krueger, Zellnor Myrie, Jessica Ramos, Gustavo Rivera, and Julia Salazar.

Jeffrey Dinowitz was behind the legislation in the Assembly.

New York State Opportunity Zones (Empire State Development Corp. (https://esd.ny.gov/opportunity-zones)

The opportunity zones, which will now come with just the federal tax break, will remain in effect until at least 2026.

Gianaris’ legislation had the backing of two dozen community, labor, and advocacy organizations. They published a joint memo in support of ending the state tax break earlier this year.

“The more we learn about the federal Opportunity Zone program, the clearer it becomes that it was a massive mistake,” said Pat Garofalo, Director of State and Local Policy at the American Economic Liberties Project, a non-profit organization that was established to highlight corporate abuse.

“There’s no reason states should have to pay for that error in their own budgets. Hopefully New York becomes an example that many other states choose to follow,” Garafalo added.

Gianaris’ legislation was criticized by the real estate industry before the state budget was passed.

The Real Estate Board of New York, a trade organization that represents large developers, said Gianaris’ proposal was misguided and said that it was bad time to introduce such legislation.

“At a time when we need more jobs, more housing and more investment…this legislation takes us in the opposite direction and puts New York at a competitive disadvantage,” a REBNY spokesperson said in a statement in February.

“We are in an economic crisis in which, for example, citywide construction activity has hit its lowest level in nearly a decade,” the spokesperson added.

New York State Opportunity Zones (Empire State Development Corp. (https://esd.ny.gov/opportunity-zones)

A small piece of Jackson Heights carved out as an Opportunity Zone

Flushing Creek was designed as an opportunity zone