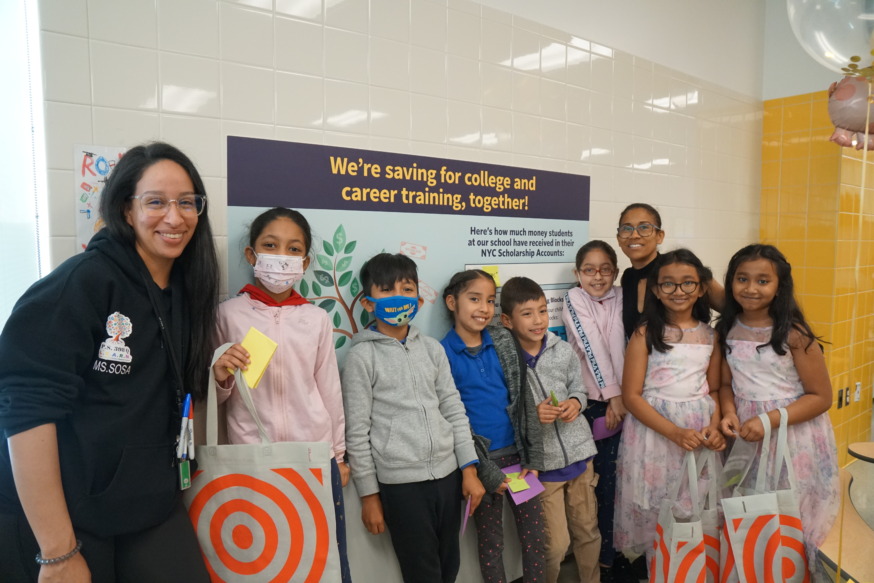

NYC Kids RISE will inform parents in Jackson Heights on how they can set up college savings accounts for their children during a marketplace in front of P.S. 398Q on Friday. (Photo by Nicole Chin-Lyn)

May 24, 2023 By Bill Parry

P.S.398Q will promote its Saving for College Program with NYC Kids RISE Friday morning transforming the 34th Avenue Open Street in front of the Jackson Heights school into a vibrant marketplace that will empower students and their families about financial education.

The event, known as 529 Market Day, for May 29, is observed annually to increase awareness about plans families can use to save for college.

“529 Day is an opportunity for communities to come together and honor the ways we are building a financial foundation for our children’s educational futures,” NYC Kids RISE Founding Executive Director Debra-Ellen Glickstein said. “Through school-based activities in the classroom where students reflect on the theme ‘Who helped you get to where you are today?’ and events where families are encouraged to activate their child’s NYC Scholarship Account, the Save for College Program community is letting students and families know they are not alone in the journey toward building financial assets for their educational futures. Cheers to the P.S. 398 and Jackson Heights community for their leadership.”

NYC Kids RISE launched the initiative in western Queens schools in 2017 to inform families on how they can activate the NYC Scholarship Accounts to begin saving for their children’s future. To date, 145,000 students citywide have college savings accounts through NYC Kids RISE with more than $18 million in total.

Research has shown that a child with even a small savings account of just $1 to $500 is three times more likely to go to college and more than four times more likely to graduate than a child without an account. (Photo by Nicole Chin-Lyn)

“Through the Save for College Program, P.S. 398Q’s Market Day is an example of how schools across the city are providing practical, engaging, and educational activities that get our students excited about their financial futures, no matter their family’s income or immigration status,” said NYC Mayor’s Office of Equity Commissioner Sideya Sherman. “The earlier we can engage our children in financial education, the better-equipped they will be to make smart financial decisions that can influence generations to come. It starts here at 529 Day celebrations in our school communities.”

This is the third year that the Hector Figueroa School is hosting this event at 69-01 34th Ave. and more than 300 families are expected to participate from 10 to 11 a.m. for the K and 1st grade market session. The 529 Day event provides the opportunity to honor the collective steps that families, schools and communities are taking today to build a financial foundation for the youngster’s educational future.

(Photo by Nicole Chin-Lyn)

“At our third annual 529 Market Day event, students at P.S. 398Q actively learn about and experience saving, budgeting and spending by practicing buying and trading goods and services provided by their peers, teachers and community. This event has blossomed beyond our vision for supporting students learning about financial literacy,” said Erica Ureña-Thus, founding principal of P.S. 398Q The Hector Figueroa School. “In partnership with various community organizations, including the 34th Avenue Coalition and 115th Police Precinct, teachers — notably our Project Based Learning organizer and first-grade dual language teacher, Ms. Veronica Sosa — and parents, this event is one of many activities throughout the school year that demonstrates the strong community of support that students and families have through the Save for College Program.”

Each of the 145,000 scholarship accounts are invested by NYC Kids RISE in a college and career savings plan in New York state called the NY 529 Direct Plan, which is the country’s main college and career savings tool, providing access to investment earnings alongside federal and state tax breaks. The scholarship funds can be used for tuition, fees, equipment, some room-and-board expenses, and even textbooks, which are often not covered by other scholarships.

“We are so proud of the annual 529 Market Day at P.S. 398Q. This is just one of the many creative ways schools are incorporating financial education into their classrooms,” said Sabine Maura, senior director of external partnerships, Save for College Program, Office of Student Pathways at NYC Public Schools. “Our students are building real skills while learning about the fundamentals of money management — saving, budgeting, and spending. The best part is that they do this right alongside their parents who are empowered with a universal tool for building bright financial futures for their children through the Save for College Program.”