NYPD

Aug. 15, 2017 By Jason Cohen

State Senator Jose Peralta (D-East Elmhurst) introduced legislation earlier this month that would require banks and other businesses with ATMs to post signage warning users about the criminal practice calling skimming.

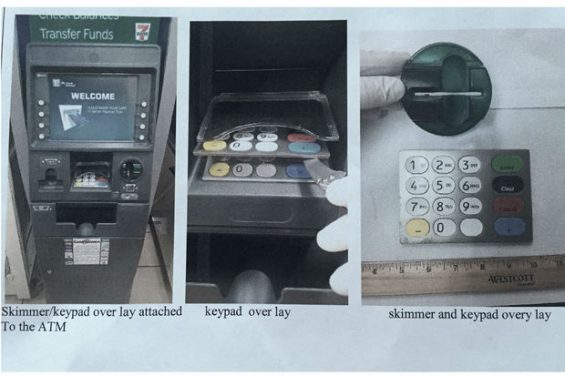

On a daily basis, consumers use ATMs without incident. However, in some instances, thieves place skimming devices on the top of card readers so they can copy the ATM user’s card information. The thieves also install fake keypads on the machines or place a camera by the ATM in order to record a person’s PIN number.

The criminals then make identical copies of the cards and use it with the stolen PIN to commit fraud.

Peralta, who said that he has fallen victim to the scam, said that many of his constituents have also been defrauded by skimmers. When he heard their stories, he said, he was shocked that banks, bodegas and other businesses with ATMs did not have signage warning consumers about skimming.

The number of people involved in skimming appears to be on the rise, Peralta said, “yet they are difficult to catch.”

“This is a consumer protection issue that I think people should be aware of,” Peralta said. “There should be some sort of signage warning people what to look for.”

In March, a study from FICO reported that there was a 70 percent increase in the number of debit cards that were compromised in 2016 at ATMs and at card readers used by merchants, compared to 2015. It also revealed that the number of card readers at ATMs and merchant devices that were hacked rose 30 percent.

“In order to protect consumers, we need to ensure that they are made aware of this burgeoning threat, the ways in which they can protect themselves from it, and how to make a report to the Attorney General if they believe they have been victimized,” Peralta said. “This legislation will help to accomplish these aims, and help keep the consumer’s hard-earned money from falling into the hands of criminals.”

According to Michael Betron, a FICO senior product manager, those most at risk of debit card theft are people who use nonbank ATMs, such as the ones in convenience stores, and remote gas stations.

The police recommend that consumers, to protect themselves from skimmers, pull on the actual card reader since the skimming devices are not affixed with any type of glue or device. They also recommended that card owners shield keypads with their hands or wallets when inputting a PIN.

One Comment

Wow great, put signs up. Tell him to sweep the street too. This guys a clown.